Ahoy there, modern worker, want to know more about the gig economy and financial planning?! Have you ever noticed how the traditional 9-to-5 job is becoming a thing of the past? Dive right into the sea of the gig economy, where waves of freelancers, independent contractors, and side-hustlers ride their boats. But as thrilling as these waters might be, navigating the financial currents requires a keen sense of planning. After all, when your income ebbs and flows like the tide, how do you keep your ship steady?

Contents

- 1 Understanding the Gig Economy

- 2 The Pros and Cons of Gig Work

- 3 Staying Afloat: Financial Planning in the Gig World

- 4 Seeking Guidance: Financial Advisors in the Gig Economy

- 5 Digital Tools: The Modern Compass

- 6 Staying Updated: The Changing Tides

- 7 Conclusion: The Gig Economy And Financial Planning

- 8 FAQs

Understanding the Gig Economy

The gig economy, often heard in today’s buzzing marketplaces, represents a seismic shift in how we view work and service provision. Think about it: Gone are the days when hailing a cab was the norm; today, a tap on our smartphones brings a car to our doorstep.

And why book a hotel when someone’s cozy apartment feels much homelier? This transformation isn’t just about the wonders of technology; it’s a reflection of our evolving work culture. The allure of this economy is its promise of flexibility. No more clocking in and out at rigid hours.

It’s about autonomy, choosing when and how you work. More people are trading traditional employment for gigs, captivated by the dream of crafting their own schedules and steering their professional destinies.

The Pros and Cons of Gig Work

Ah, the allure of the gig economy! Like a bed of roses, it tempts with the promise of freedom and flexibility. Dream of working in your pajamas or choosing projects that ignite your passion? Gig work says, “Come aboard!” But, tread carefully, for among these roses are hidden thorns.

The unpredictable nature of gigs means the security of a steady paycheck remains elusive. One month, you might be swimming in assignments; the next, it’s a barren desert. And let’s talk benefits – or the lack thereof. Remember the comforting shield of health insurance in traditional jobs?

In the gig world, you’re often left forging that shield yourself. So, while the gig economy dazzles with its freedoms, it also demands resilience and astute financial planning to navigate its inherent challenges. Like any rose, it’s about appreciating the beauty while being wary of the thorns.

Staying Afloat: Financial Planning in the Gig World

Navigating the tumultuous waters of the gig economy can feel daunting. Like a sailor amidst the vast, unpredictable seas, the gig worker faces waves of income inconsistency and storms of unexpected expenses. But fear not! Just as a sailor relies on a trusty compass, gig workers have a beacon to guide them: astute financial planning. This involves charting out your income streams, anticipating dry spells, and having a safety net for those “rainy days”.

It’s about setting clear financial goals, budgeting with foresight, and ensuring a buffer for life’s unforeseen financial squalls. Diversifying income sources, just as a sailor would have multiple navigational tools, also aids in steady sailing. With the right planning, even in the vast, ever-changing gig economy ocean, one can sail confidently, knowing they’re on course to financial stability. Ready to set sail? Lets go:

Emergency Funds: The Life Jacket

Imagine the weight of an anchor pulling you down in deep waters—terrifying, right? That’s the crushing burden of unforeseen financial emergencies. But, there’s a lifesaver: an emergency fund. This financial cushion, equivalent to about 3-6 months of your living expenses, acts as a buffer, keeping you afloat amidst economic storms. It’s not just about survival; it’s about sailing through rough patches with confidence. So, gear up, build that safety net, and ensure that no financial turbulence sinks your ship.

Embarking on a financial journey without a plan? It’s like a treasure hunt without a map! Budgeting provides that crucial guide, helping you chart a clear path amidst monetary twists and turns. It’s the tool that marks potential pitfalls, highlights opportunities, and ensures you’re always on track. By monitoring income and accounting for lean periods, you allocate resources effectively. Remember, budgeting isn’t about putting shackles on your spending; it’s the compass that ensures every coin spent moves you closer to your treasure: financial stability and success.

Insurance: The Sturdy Ship

Venturing into the vast sea of the gig economy without protection? That’s like a sailor braving storms without a robust vessel. Insurance acts as this fortified ship, guarding against unpredictable financial tempests. Whether it’s unforeseen medical expenses or professional liabilities, the right insurance coverage ensures you stay on course. It’s not just about weathering challenges; it’s about sailing confidently, knowing you’re shielded from the unexpected gales life might throw. So, anchor your journey with solid insurance, and let no storm divert your path.

Retirement Planning: The Distant Shore

Picture a tranquil beach, the sun setting, casting golden hues—this could be your retirement paradise. But to anchor on this peaceful shore, the voyage starts today. Early planning for retirement is like setting sail at dawn; you harness the day’s full potential, allowing your savings ample time to compound and flourish. Delay, and you might find yourself battling rough seas. So, chart your course towards that distant, serene beach now, and ensure your retirement journey is smooth sailing all the way.

Investments: The Favorable Winds

Embarking on your financial voyage, you’ll seek forces that accelerate your progress. Investments act as those favorable winds, giving momentum to your savings. Like a seasoned sailor harnessing varied winds, diversifying across assets like stocks, bonds, and real estate ensures you capitalize on the best opportunities. It’s not just about riding the current; it’s about strategically channeling these financial breezes to propel you towards your goals. With smart investments, you harness the full potential of the financial seas, steering towards prosperity.

Taxes: The Pirates of the Sea

Venturing through the gig economy’s waters, you’re bound to encounter the formidable pirates: taxes. These unavoidable adversaries can swiftly plunder your hard-earned treasures if you’re unprepared. But fear not! Like a vigilant sailor, setting aside a portion of your bounty safeguards against these surprise raids. And don’t sail solo—enlisting a seasoned tax professional ensures you navigate these treacherous waters adeptly. With the right guidance, you can keep the pirates at bay, ensuring your treasures remain intact and your voyage remains profitable.

Seeking Guidance: Financial Advisors in the Gig Economy

In the vast, often unpredictable sea of the gig economy, even the most skilled sailors sometimes need guidance. Enter financial advisors, the seasoned mariners of the financial realm. With their vast knowledge, experience, and understanding of the ebb and flow of financial tides, they can steer you clear of potential pitfalls.

Like ancient mariners who used stars to navigate, these experts help illuminate the most prudent paths for your unique journey. Whether it’s devising a budget, strategizing investments, or planning for retirement, their expertise can be invaluable. Consulting with them offers clarity amidst the fog, equipping you with insights to make informed choices.

In the dynamic gig economy, where income streams might be varied and volatile, having a trusted advisor by your side ensures you’re always sailing in the right direction. Set your course with confidence, knowing you have a seasoned navigator to guide you.

Digital Tools: The Modern Compass

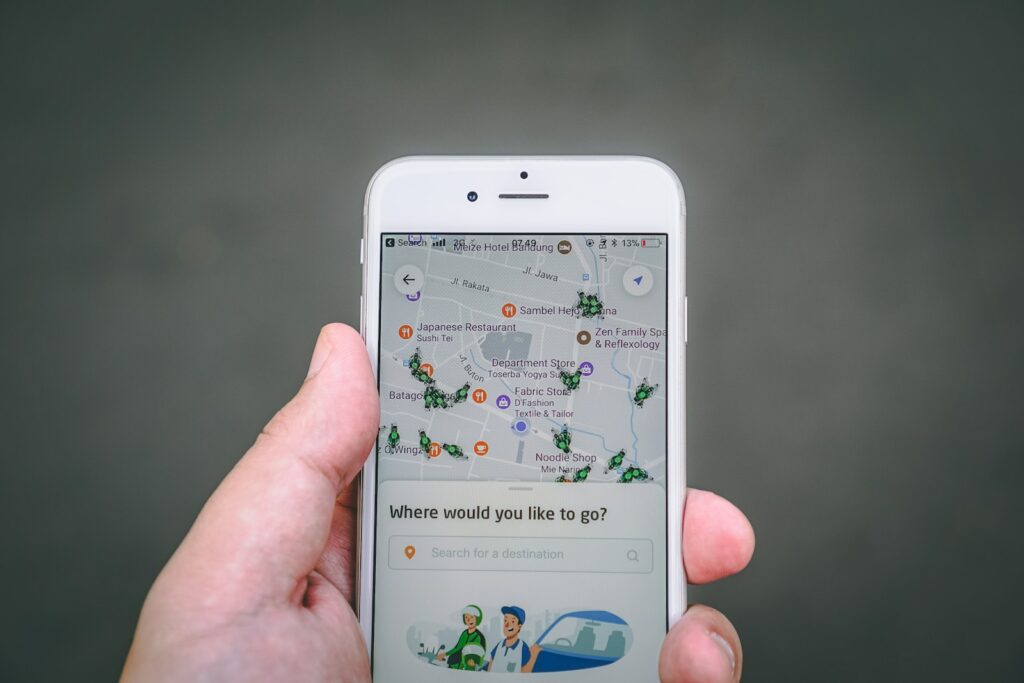

In the age of discovery, explorers relied on compasses to chart unknown territories. Fast forward to today, and the gig economy’s adventurers have a modern equivalent: digital tools. Thanks to technological advancements, there’s a veritable treasure trove of financial apps and platforms specifically designed for the independent worker.

Need to keep an eagle eye on your fluctuating income? There’s an app for that. Wrestling with a horde of invoices? Digital platforms can tame that beast. These tools are not just about convenience; they provide precision, ensuring every financial decision is informed and calculated.

Just as a compass points sailors towards their desired destination, these digital aids guide gig workers through the intricate maze of financial management. In this evolving work landscape, arming oneself with the right digital compass can make the journey not only smoother but also more rewarding. Embrace tech, and navigate your financial seas with confidence.

Staying Updated: The Changing Tides

The gig economy, much like the vast oceans, is ever-changing, with tides that ebb and flow, bringing both treasures and trials. As new platforms emerge, regulations evolve, and market demands shift, those navigating this realm must remain agile, adapting to the currents.

But how? The key lies in staying informed. Whether it’s attending webinars, subscribing to industry newsletters, or participating in relevant workshops, continuous education is the beacon that guides gig workers through murky waters. Embracing a mindset of lifelong learning ensures you’re not caught off-guard by sudden storms or changing winds.

It empowers you to seize new opportunities, tackle challenges head-on, and remain at the forefront of your field. In a world where the only constant is change, riding the wave of knowledge ensures you not only survive the shifting tides but truly thrive in them.

Conclusion: The Gig Economy And Financial Planning

The gig economy, with its flexibility and autonomy, is reshaping the workforce landscape. While it offers numerous opportunities, navigating its financial waters demands careful planning and strategy. But with the right tools, guidance, and a proactive approach, you can sail smoothly towards financial stability and success. After all, in this vast sea of gig work, isn’t financial peace of mind the true treasure?

FAQs

1. What exactly is the gig economy?

The gig economy refers to a labor market characterized by short-term contracts, freelance work, and independent contracting, as opposed to traditional permanent jobs.

2. Why is financial planning crucial in the gig economy?

Given the unpredictable nature of gig work income, financial planning ensures stability, helps manage irregular cash flow, and prepares for unforeseen financial challenges.

3. Are there specific financial tools tailored for gig workers?

Yes, several digital apps and platforms cater specifically to gig workers, offering features like income tracking, tax calculations, and invoice management.

4. How can gig workers plan for retirement?

Gig workers can explore options like IRAs, solo 401(k)s, or even SEP IRAs, ensuring they regularly contribute and invest wisely for their retirement.

5. Can gig workers avail of health insurance?

While gig jobs typically don’t provide health benefits, workers can explore individual health insurance plans or join professional groups that offer group

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by FinanceOpinion.net and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.