Real-Life Case Studies: How Debt Consolidation Improved Financial Stability

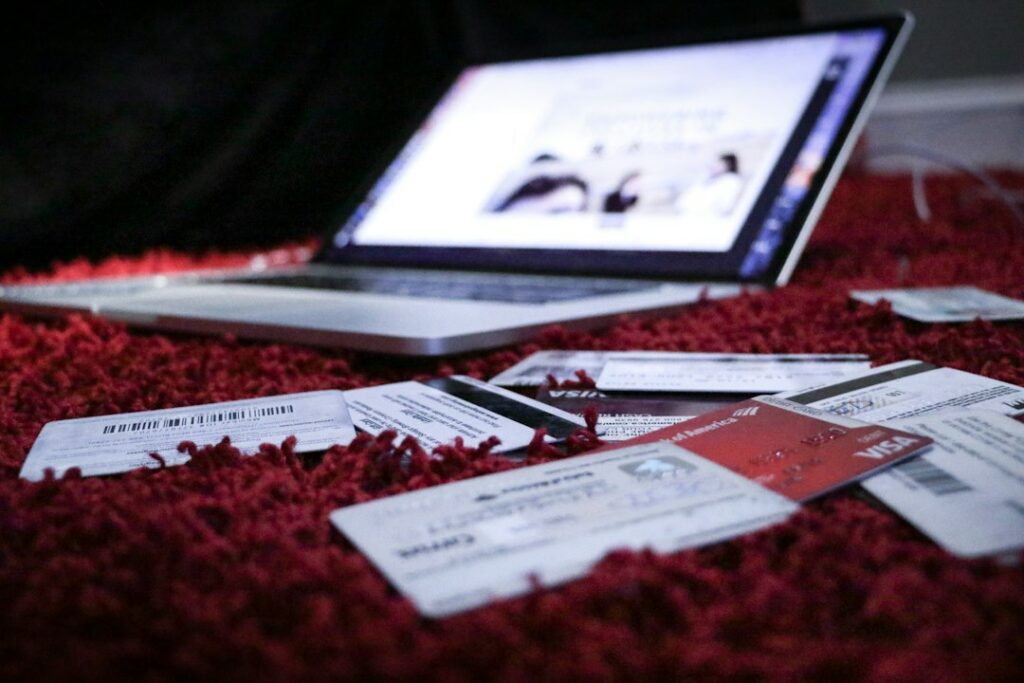

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan or payment. It is often pursued by individuals who are struggling to manage their debt and are looking for a way to simplify their financial situation. By consolidating their debts, individuals can potentially lower their interest rates, reduce their monthly […]

Real-Life Case Studies: How Debt Consolidation Improved Financial Stability Read More »