Ahoy, financial navigator! Ever looked at a map and wondered where to begin? Well, analyzing a budget can sometimes feel like deciphering a treasure map. Dive in with me, and let’s unearth the secrets of budget analysis together, step by step!

Contents

- 1 The Art of Budgeting: Why It Matters

- 2 Starting with Income: Counting the Treasure

- 3 Tracking Expenditure: Charting the Waters

- 4 Goals & Aspirations: X Marks the Spot

- 5 Tools & Aids: Your Trusty Compass

- 6 Investments & Savings: The Treasure Troves

- 7 Debts & Liabilities: Navigating Stormy Seas

- 8 Regular Review: Updating the Map

- 9 Seeking Expert Advice: Consulting the Star Maps

- 10 Conclusion

- 11 FAQs

The Art of Budgeting: Why It Matters

Let’s set the scene. You’ve embarked on your financial journey with ambitions. Maybe you’re eyeing how to start investing in real estate or simply wish to open the best banks with savings account. No matter the goal, without a proper map (read: budget), you’re sailing blind. And who wants that?

Starting with Income: Counting the Treasure

Begin at the source! How much is coming in? This is your treasure chest. From salaries to side gigs, calculate every doubloon. Is your income steady, like the steady interest from a best high yield savings account? Or does it ebb and flow?

Tracking Expenditure: Charting the Waters

Next, list out your expenditures. This is where things get tricky. Are you spending more on credit cards for fair credit than you should? Or perhaps you’ve taken out loans to build credit and are figuring out repayments? Every coin counts!

Goals & Aspirations: X Marks the Spot

What’s a journey without a destination? Whether it’s understanding what credit score is needed to buy a house or seeking how to get investment property loan, pin down those goals.

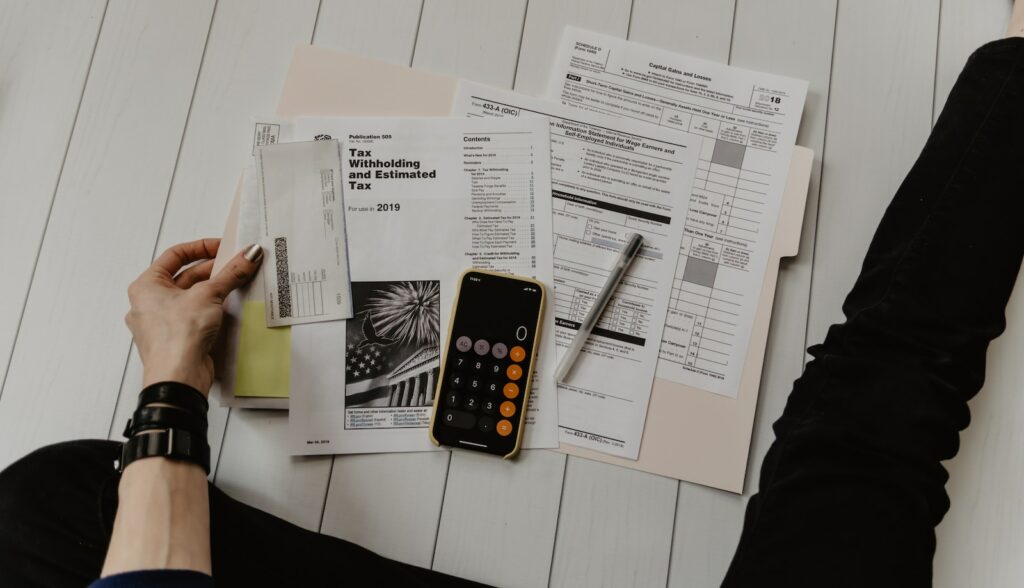

Tools & Aids: Your Trusty Compass

Consider this: Would Columbus have discovered America without his compass? In our modern world, good budgeting apps are our digital compasses. They help streamline the budgeting process and keep us on track.

Investments & Savings: The Treasure Troves

Dipping your toes into what to invest in during a recession? Or perhaps eyeing the best savings account interest rates? Your investments and savings are the hidden coves of your financial map. Dive deep and see how they’re faring.

Ahoy, rough waters ahead! Debts can be treacherous, like unexpected storms. Be it from banking for small businesses or personal loans, understanding your liabilities is crucial.

Regular Review: Updating the Map

Remember, old maps can lead to dead ends. Regularly review and adjust your budget, especially if your priorities shift. Want to explore best ways to build credit? Update that map!

Seeking Expert Advice: Consulting the Star Maps

Sometimes, celestial navigation is the way to go. Financial advisors can provide expert insights tailored just for you. After all, even pirates sometimes needed guidance, right?

Conclusion

Charting your financial journey, is analyzing a budget really akin to treasure hunting? In many ways, yes! Both require a good map, a sense of direction, and the ambition to reach one’s goals. So the next time you’re pondering “How To Analyze A Budget?”, remember: you’re the captain of your ship, navigating the vast seas of personal finance. And who knows what treasures you’ll find?

FAQs

- How often should I review my budget?

Regular reviews, preferably monthly, can help keep your budget aligned with your goals. - Is it essential to use a budgeting app?

While not mandatory, a good budgeting app can simplify tracking and analysis, acting as a modern compass in your financial journey. - How do I prioritize paying off debts or saving?

It’s a balance. Consider interest rates on debts versus potential returns on savings. Consulting with a financial advisor can also provide clarity. - Should I include one-time expenses in my budget analysis?

Absolutely! Unexpected or one-time costs can greatly impact your financial stability. Always account for them. - How do investments factor into a budget analysis?

Investments represent potential future income and growth. Analyzing them ensures they align with your long-term financial goals.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by FinanceOpinion.net and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.