Comparing Top Micro-Saving Apps: Features, Fees, and User Experience

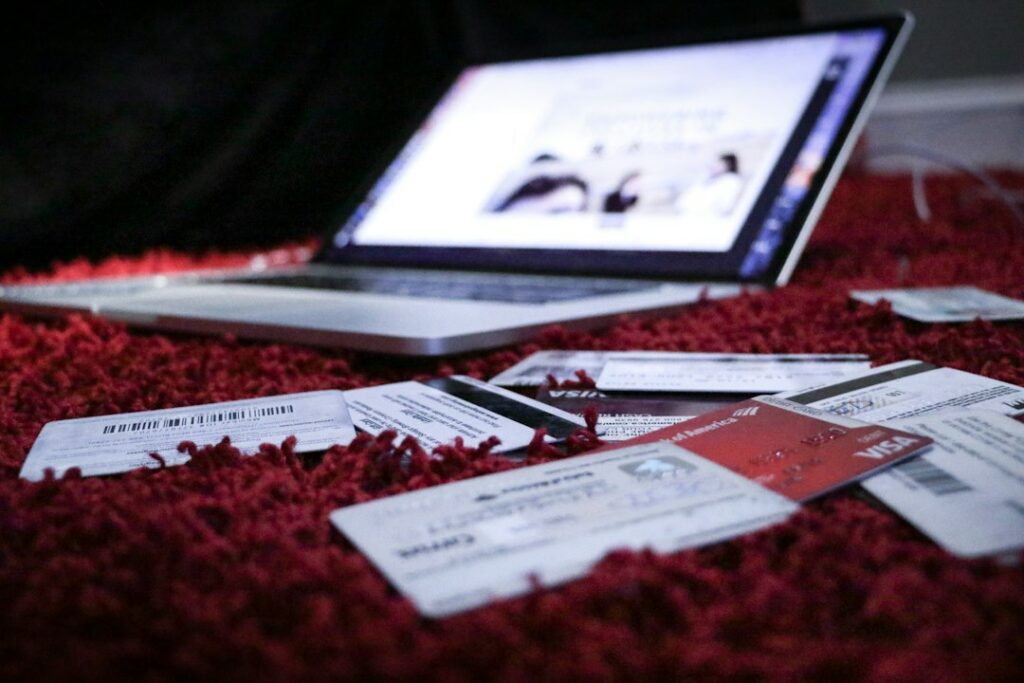

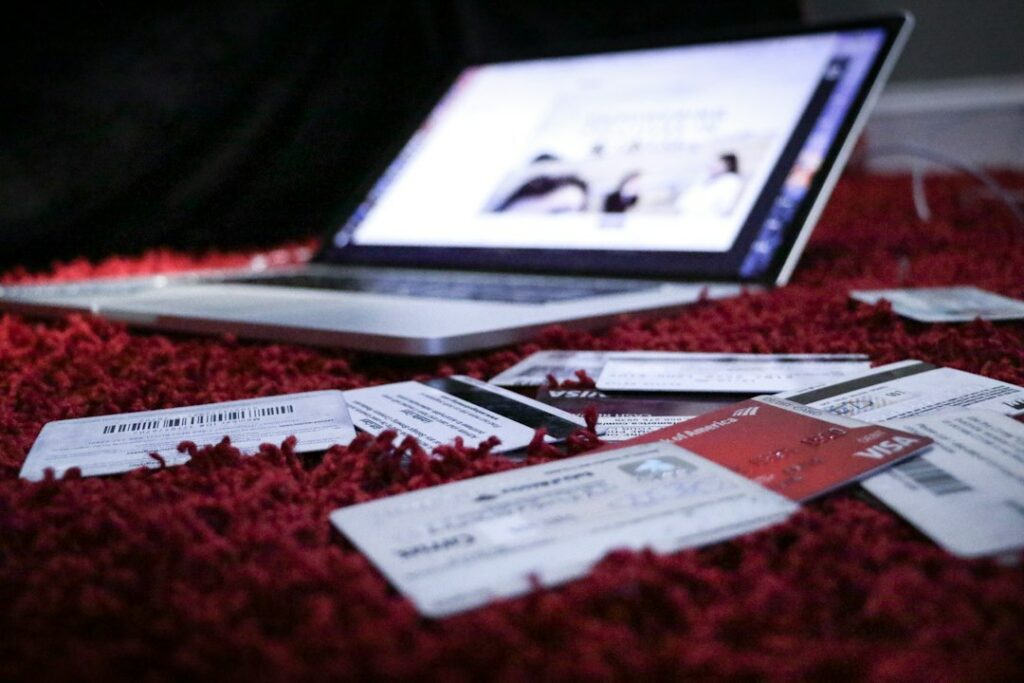

In today’s fast-paced world, it can be challenging to save money. However, with the rise of technology, there are now innovative solutions that can help you save effortlessly. One such solution is micro-saving apps. These apps are designed to make saving money easier and more convenient for users. In this blog post, we will explore […]

Comparing Top Micro-Saving Apps: Features, Fees, and User Experience Read More »